Benefits of AE KiwiSaver Plan

Lump sum paid to you at 65.

Save for first home

Employee contributions

Government contributions

You can withdraw your KiwiSaver savings to purchase your first home.

As a KiwiSaver member you can qualify for Housing New Zealand Assistance Grant.

Lump sum paid to you at 65.

Save for first home

Employee contributions

Government contributions

Unique strict ethical investment mandate

Actively managed risk profile

Invests in strong balance sheet companies in the US market

Selects and manages its investments - no outsourcing

Compliance with strict ethical mandate is checked daily

We are based in New Zealand

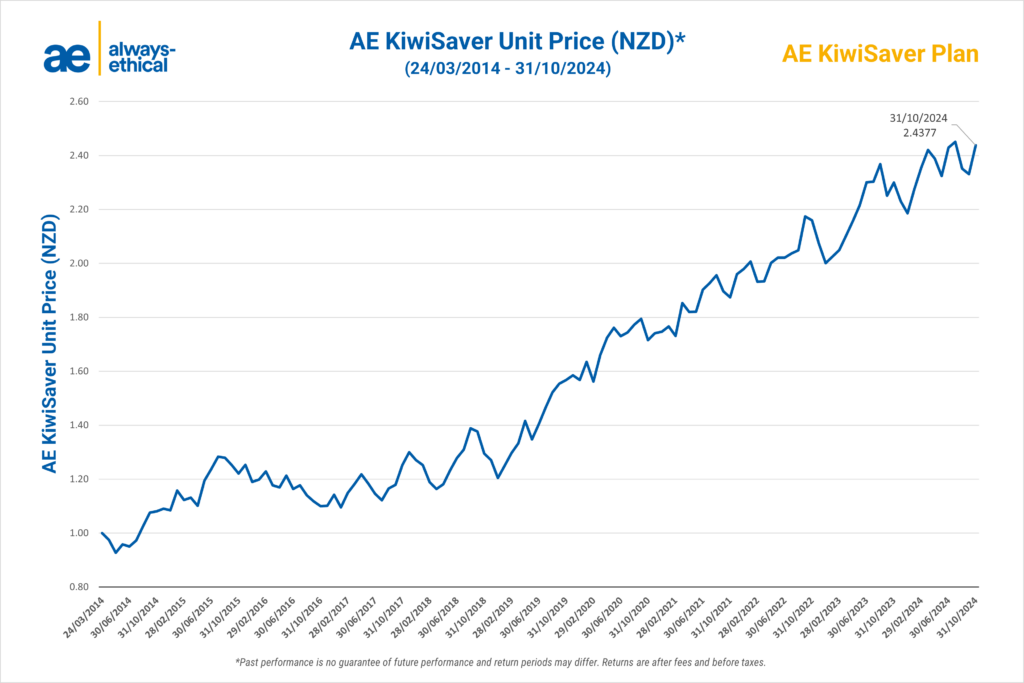

Investment Performance Returns

(Net of Expenses and Before Tax) to 31st October 2024 (unaudited)

The AE KiwiSaver Plan Product Disclosure Statement (PDS) describes how AE KiwiSaver Plan works and provides you with information about who is involved in providing it.

Before deciding to join AE KiwiSaver Plan, you should read the PDS, and if necessary, obtain independent financial advice.

You can begin investing in AE KiwiSaver Plan by completing the application form (and providing the supporting documents) at the back of the Product Disclosure Statement (available for download here)

Our investment objective for AE KiwiSaver is to increase the rate of average annual return to Scheme Members over the long-term, while complying with the confines of the Scheme’s Ethical Mandate. As Manager, our aim is to protect the value for all Scheme Members in times of volatility, while maximising gains in times of growth.

Our investment approach is based off the following principles:

We invest in AE Investor.

KiwiSaver is a long term investment (47 years for an 18 year old).

Our investments all are doing or making something for the good of humanity.

We consider our Strict Ethical Mandate provides transparency to members and let them take responsibility for how their investment affects society.

We believe that applying our Strict Ethical Mandate mitigates investment risk by applying strict rules to the balance sheet analysis of our investments.

We believe that investment returns can be improved by a strict monitoring and governance framework.

Our investment committee selects our investments, we invest directly so there are no hidden fees, the AE KiwiSaver Investment team is the same personnel as AE Investor.

The Investment Committee monitors the risk profile of the investments by deciding the ratio of equities to cash.

The target mix is reset by the Managers Investment Committee (IC) as the market conditions dictate. The Investment Committee from time to time has regard to the market conditions and assesses the ratio of equities to cash and the risk to the investor’s funds. AE Investor is designed to employ the risk mix as the Investment Committee considers appropriate from 100% equites to 100% cash. The manager describes the fund as aggressive as it may at any time have 90 – 100% of its assets invested in equities.

When the Investment Committee considers the market conditions, it dictates its holdings under 34% in equities making it, by the table below, (copied from the NZ Government’s Sorted website) by their definition, a conservative fund.

Fund – Risk Type | % Equities | % Cash | Aggressive Growth Balanced Conservative Defensive | 100 – 90% 89.9 – 63% 62.9 – 35% 34.9 – 10% 0 – 9.9% | 0-10% 10.1 – 37% 37.1 – 65% 65.1 – 90% 90.1 – 100% |

|---|

KiwiSaver is a voluntary work-based savings initiative to help you save for your retirement. Most members will build up their savings through regular contributions from their pay.

You can join the Scheme if you are a New Zealand citizen or are entitled to live in New Zealand indefinitely; live or normally live in New Zealand; and are under the New Zealand superannuation age

KiwiSaver has a range of membership benefits 1. Employer contributions, 2. Government contributions, 3. First home withdrawal (conditions apply).

When you reach the KiwiSaver retirement age, you may continue to keep making contributions; however, the Government will stop contributing.